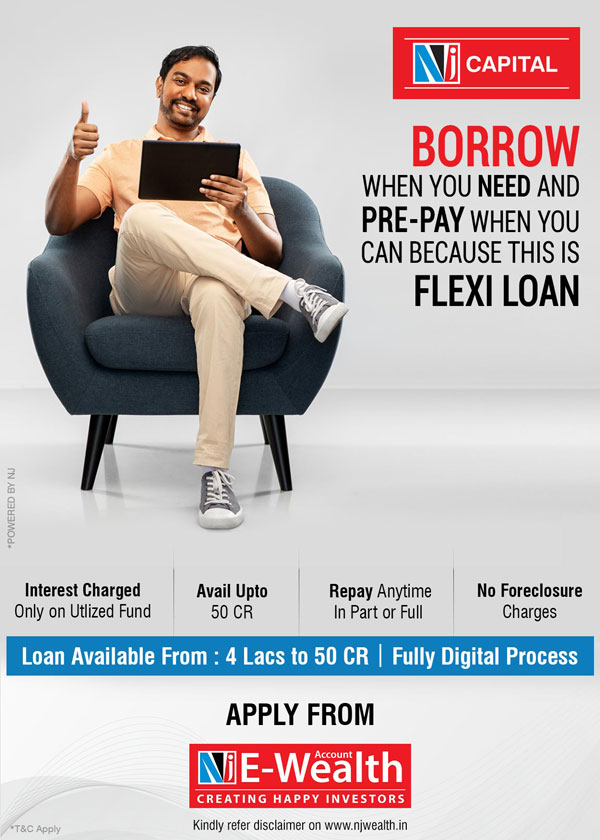

Ans. The Borrower shall be required to maintain double the margin of utilized funds at all times.

As per RBI & SEBI guidelines, Client has to regularize the account by paying a shortfall amount or by pledging double securities of shortfall within 7 days.

Mail communication is done to the client by Bajaj team from the 1st day of the margin shortfall. NJ Capital also sends mails to partners, clients and sales team.

Client has to regularize his account on or before the date given by Bajaj.

If Client does not regularize the account & communicate to Bajaj then they will sell double securities to recover the margin shortfall and regularize the Account.

Clients can check the updated margin shortfall amount from the IVR report.

If the market goes down during the repayment date then the client has to pay a higher shortfall amount reflecting in IVR on the due date.

"We have taken due care and caution in compilation of this E Newsletter. The information has been obtained from various reliable sources. However it does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions of the results obtained from the use of such information. Investors should seek proper financial advise regarding the appropriateness of investing in any of the schemes stated, discussed or recommended in this newsletter and should realise that the statements regarding future prospects may or may not realise. Mutual fund investments are subject to market risks. Please read the offer document carefully before investing. Past performance is for indicative purpose only and is not necessarily a guide to the future performance."